Table of contents

Gold Price News: Record hunt and geopolitical turbulence drive the market

Dr. Mathias Kunze

Senior Consultant in Commercial and Tax Law

6 min.

Published on: 10.02.2025 | 20:40 UTC

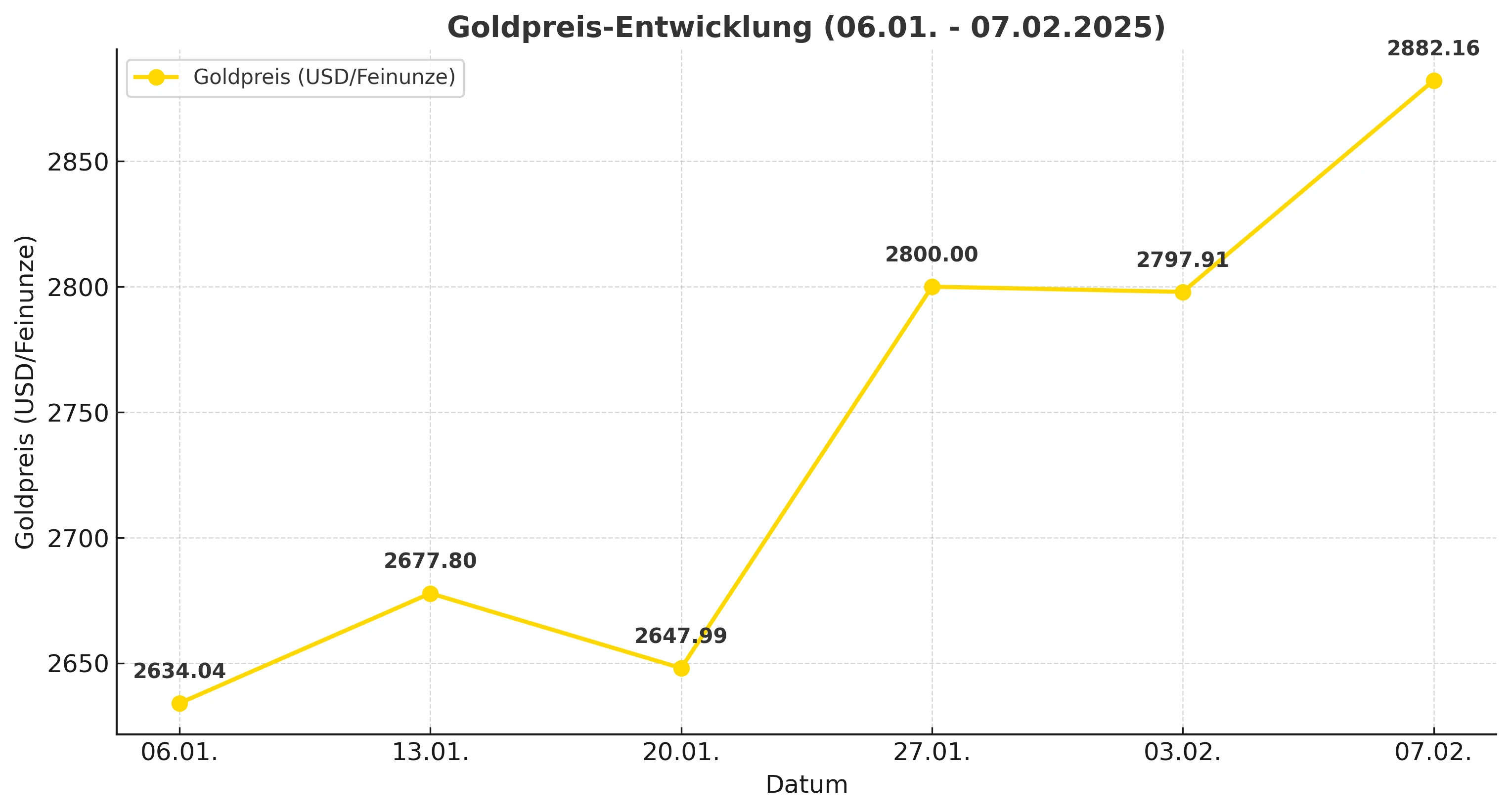

Gold price and important market developments from 06.01.2025 to 07.02.2025 in the live ticker

Source: ChatGPT (OpenAI)

Key Facts

✅ Gold price development:

📈 +248 USD since the beginning of the year – from 2,634.04 USD (06/01) to 2,882.16 USD (07/02)

✅ Market drivers:

📌 US tariffs and trade conflicts: New measures by President Trump led to market disruptions.

📌 Central bank purchases: High demand for gold from China, Russia and other countries.

📌 Geopolitical tensions: Hot spots such as the Middle East and Asia intensified the price increase.

📌 Rising borrowing costs for gold: Bottlenecks in the London market drove up prices further.

📌 US financial policy: Speculation about possible gold revaluation by the US government.

✅ Market forecast:

📊 Analysts consider $3,000 per ounce to be realistic in 2025.

Over the past few weeks, we have made extensive technical and visual improvements to the gold.biz platform to make reporting even more accurate, user-friendly and efficient. These optimizations enable a faster and more structured delivery of future live ticker updates, so that all readers are even better informed about developments in the gold market. With the comprehensive review below, we now offer a complete review of the key events from January 06 to February 07, 2025, to ensure a complete market overview.

Gold price in the week from January 06 to January 10, 2025

In the week from January 06 to January 10, 2025, the gold price developed positively and recorded a significant increase. At the beginning of the week, the spot price was 2,634.04 USD per troy ounce, while it rose further to 2,677.80 USD by January 10, 2025. In Vietnam in particular, the gold price reached a new high of 86 million VND per tael, due to global price movements.

A key driver of this development was the continued buying of gold by central banks, which further expanded their reserves. These purchases contributed significantly to the stability and price increase. At the same time, geopolitical tensions led to increased market volatility. In particular, ongoing uncertainties in the Middle East and trade tensions between the US and China intensified market movements.

Analysts see this as a harbinger of a potentially even stronger rally over the course of 2025, as economic policy decisions and global trade structures will continue to be high on the agenda. A development of the gold price per troy ounce of 3,000.00 USD over the course of 2025 does not appear unrealistic.

Gold price in the week from January 13 to January 17, 2025

During the week of January 13 to January 17, 2025, the gold market continued its upward trend. On Monday, January 13, 2025, the spot price opened at 2,690.70 USD per troy ounce. Over the course of the week, the price continued to rise, reaching a high of 2,700.00 USD per troy ounce on Friday, January 17.

This development was significantly influenced by ongoing geopolitical tensions – in particular, uncertainties surrounding US trade policy under President Donald Trump. The introduction of new tariffs on imports from China led to countermeasures and increased demand for gold.

In addition, strong purchases by central banks contributed to the price increase. According to the World Gold Council, global demand for gold rose by 1% in 2024 to a record high of 4,974.5 tons, driven further by investment and central bank purchases.

Market volatility increased slightly in the second week of the year as investors reacted to conflicting signals from the Federal Reserve's monetary policy and global economic data. While some analysts do not rule out a possible correction in the gold price due to short-term profit-taking, the long-term outlook remains optimistic. The rising demand for gold ETFs was particularly noticeable, reflecting growing institutional interest in the precious metal. In addition, trading volumes on the futures markets pointed to increasing hedging against currency and inflation risks, which provided additional impetus for the gold price.

Gold price in the week from January 20 to January 24, 2025

In the week of January 20–24, 2025, the gold market saw a sideways price movement. On Monday, January 20, 2025, the spot price opened at 2,626.02 USD per troy ounce. Over the course of the week, the price moved in a narrow range and closed at 2,647.99 USD per troy ounce on Friday, January 24.

This stability was influenced by mixed signals from the global economy. On the one hand, ongoing trade conflicts created uncertainty, while on the other hand, positive economic data from the US supported the markets. Analysts observed increasing reluctance among investors, who were waiting for clear indications of the future direction of the gold price.

Despite this week's sideways movement, the long-term outlook for gold remains positive. Experts predict that ongoing geopolitical tensions and economic uncertainties will continue to support the precious metal. In addition, potential monetary easing by central banks worldwide could boost demand for gold in the coming months. Overall, the third week of January reflected a period of consolidation, with the gold market awaiting fresh impetus to take a clear direction.

Gold price in the week from January 27 to January 31, 2025

In the week of January 27 to January 31, 2025, the gold market continued its upward trend. On Monday, January 27, 2025, the spot price opened at 2,763.24 USD per troy ounce. During the course of the week, the price rose continuously to reach a new record high of 2,800 USD per troy ounce on Friday, January 31, 2025.

This development was significantly influenced by uncertainties regarding the tariffs announced by President Donald Trump. The announcement of new tariffs on imports from Mexico, Canada and China led to countermeasures by these countries and increased demand for gold. In addition, sustained purchases by central banks contributed to the price increase. According to the World Gold Council, global demand for gold rose by 1% in 2024 to a record high of 4,974.5 tons, driven by investment and central bank purchases.

While the gold market as a whole benefited from positive momentum, there was an increasing differentiation between short-term speculators and long-term investors. While some traders took the opportunity to generate profits after the strong price gains, rising net long positions in gold futures indicated that institutional investors continue to expect higher prices. In addition, precious metal traders registered increased physical demand in Asia, which was particularly reflected in the Chinese market, where preparations for the New Year are traditionally accompanied by increased gold purchases. Market observers assume that seasonal effects, in combination with economic policy decisions by the US Federal Reserve, will have a decisive impact on the coming weeks.

Gold price in the week from February 03 to February 07, 2025

In the week of February 03 to 07, 2025, the gold market continued its upward trend. On Monday, February 3, the spot price opened at 2,797.91 USD per troy ounce. During the course of the week, the price rose continuously and reached a new record high of 2,882.16 USD per troy ounce on Friday, February 7.

This development was largely influenced by the announcement of new US tariffs. President Donald Trump announced a 25 percent tariff on imports from Mexico, Canada and China, which led to countermeasures by these countries and increased demand for gold.

In addition, borrowing costs for gold in London rose due to increased demand from the US. Fear of a global trade war and strong investment demand contributed to this development.

Another factor was speculation about a possible revaluation of US gold reserves. These considerations were fueled by comments from Treasury Secretary Scott Bessent, who announced creative approaches to managing US assets.

Overall, the gold market performed strongly this week, with rising prices and increased demand due to the above factors.

Dr. Mathias Kunze

Senior Consultant in Commercial and Tax Law

Blog

All-time high: Gold price breaks through USD 3,000 for the first time

Gold in industry: A detailed analysis of its interactions with halogens and in cyanide solutions